[ad_1]

Many merchants are preoccupied with discovering the proper level and predicting the proper reversal factors. Whereas all this must be theoretically sound, it’s fairly troublesome if not unattainable to execute. The proper entry level is assumed to be the precise spot the place worth reverses. Whereas I’ve skilled predicting the correct entry factors utilizing restrict entry orders a number of occasions, it’s hardly correct. Typically, worth would transfer in opposition to my place for a number of pips earlier than it goes in my course. Predicting the precise reversal level is like predicting the ideas of 1000’s of merchants. Not solely are you guessing which course they’re taking, you’re additionally predicting the precise determine the place most merchants would take the commerce. Unattainable, isn’t it?

As an alternative of guessing the precise reversal level, merchants can extra simply decipher the course which the market is heading to. That is very evident in a trending market situation. It will be very straightforward to see that worth is both trending up or trending down. As an alternative of combating in opposition to the gang and anticipating the place the pattern would reverse, it could be greatest to flow of the market as a substitute.

Knowledge of the gang is principally the collective opinion of a bunch relatively than a single knowledgeable. Within the case of buying and selling, as a substitute of making an attempt to be the “knowledgeable”, it’s best to only go along with the knowledge of the gang, which is the market itself.

Heiken Ashi Smoothed

Heiken Ashi Smoothed is a pattern following technical indicator which relies on the mix of the Heiken Ashi Candlesticks and shifting averages.

The Japanese candlesticks have been the gold normal for charting worth motion for fairly a while now. Nonetheless, one other intelligent innovation has been developed but once more by Japanese merchants. The Heiken Ashi Candlesticks is a technical indicator which plots a distinct sort of candlestick. It retains the identical highs and lows plotted by the Japanese candlesticks. Nonetheless, it additionally modifies the open and shut of every candle primarily based on the common of every candle. This creates candlesticks which change colours solely when the short-term pattern or momentum has shifted.

The Heiken Ashi Smoothed indicator alternatively is very similar to the Heiken Ashi Candlesticks as a result of it additionally plots bars on the value chart. These bars additionally point out the course of the pattern by altering its colour. Lime bars point out a bullish pattern, whereas pink bars point out a bearish pattern. Nonetheless, its similarities finish there. It’s because the Heiken Ashi Smoothed indicator behaves extra just like the Exponential Shifting Common (EMA). It plots bars which comply with worth motion fairly intently. This enables merchants to see the precise worth motion extra clearly primarily based on the candlestick patterns, whereas on the identical time establish the course of the pattern primarily based on the colour of the bars.

The Heiken Ashi Smoothed indicator is a really dependable pattern following indicator. It adjustments colour solely when the mid-term pattern has clearly shifted instructions and isn’t as inclined to false indicators very similar to different technical indicators. This makes it a really dependable pattern reversal sign indicator.

Similar to shifting averages, the Heiken Ashi Smoothed indicator can even act as a dynamic space of assist or resistance. Throughout a trending market, worth would usually bounce off its space after a retracement.

TSR Execute Line

The TSR Execute Line is a customized technical indicator which is a wonderful momentum indicator.

It identifies short-term traits or momentum primarily based on a modified short-term shifting common line. It then plots a line which identifies the motion of worth motion and signifies the course of the short-term pattern or momentum primarily based on the colour of the its line.

A yellow TSR Execute Line signifies a bullish short-term momentum, whereas a magenta line signifies a bearish short-term momentum.

Because the identify suggests, the TSR Execute Line can be utilized as a commerce execution or entry set off sign. Merchants can establish or affirm commerce entries primarily based on the altering of the colour of its line.

Buying and selling Technique

Knowledge of the Crowd Foreign exchange Buying and selling Technique is a pattern following buying and selling technique which mixes the course of the mid-term pattern and short-term momentum to substantiate a wonderful commerce setup.

The 50 EMA line and the Heiken Ashi Smoothed indicator is used to establish the course of the pattern. That is primarily based on the placement of the Heiken Ashi Smoothed bars in relation to the 50 EMA line, in addition to the colour of the Heiken Ashi Smoothed bars. Tendencies must also be visually confirmed by the dealer primarily based on the habits of worth motion.

Value ought to then retrace or contract in the direction of the realm of the Heiken Ashi Smoothed bars. Then, worth ought to create a momentum candle as worth bounces off the realm of the bars.

The TSR Execute Line ought to then affirm the momentum shift after the retracement primarily based on the altering of the colour of its line.

Indicators:

- (T_S_R)-Execute Line

- Heiken_Ashi_Smoothed

- 50 EMA

Most well-liked Time Frames: 15-minute, 30-minute, 1-hour, 4-hour and day by day charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York classes

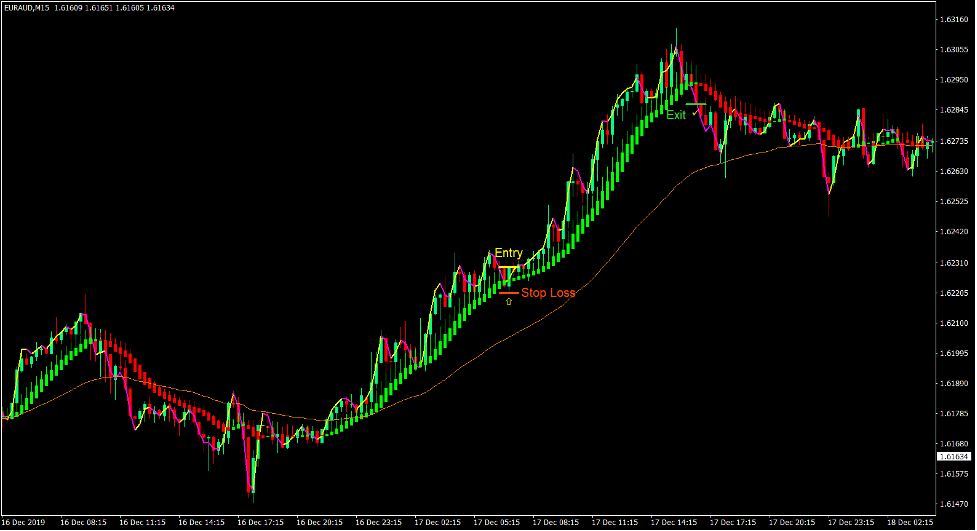

Purchase Commerce Setup

Entry

- Value motion must be trending up.

- The Heiken Ashi Smoothed bars must be above the 50 EMA line.

- The Heiken Ashi Smoothed bars must be lime.

- Value ought to retrace or contract in the direction of the realm of the Heiken Ashi Smoothed bars.

- A bullish momentum candle must be shaped.

- The TSR Execute Line ought to change to yellow.

- Enter a purchase order on the affirmation of those circumstances.

Cease Loss

- Set the cease loss on the assist under the entry candle.

Exit

- Shut the commerce as quickly as a candle closes under the Heiken Ashi Smoothed bars.

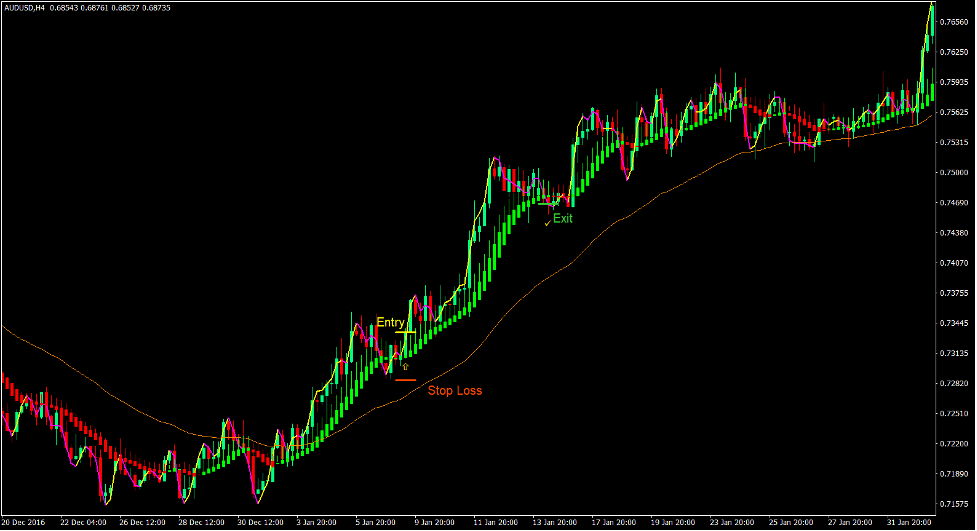

Promote Commerce Setup

Entry

- Value motion must be trending down.

- The Heiken Ashi Smoothed bars must be under the 50 EMA line.

- The Heiken Ashi Smoothed bars must be pink.

- Value ought to retrace or contract in the direction of the realm of the Heiken Ashi Smoothed bars.

- A bearish momentum candle must be shaped.

- The TSR Execute Line ought to change to magenta.

- Enter a promote order on the affirmation of those circumstances.

Cease Loss

- Set the cease loss on the resistance above the entry candle.

Exit

- Shut the commerce as quickly as a candle closes above the Heiken Ashi Smoothed bars.

Conclusion

This pattern following technique is a extremely dependable buying and selling technique that might assist merchants propel their buying and selling accounts to large earnings. Nonetheless, this technique solely works in a market that’s clearly trending on the mid-term horizon.

The important thing to buying and selling this technique profitably is in accurately figuring out the correct trending market. In the correct trending market, this technique may produce two to 3 good buying and selling alternatives. Some traits can enable for extra good commerce setups, nonetheless the chance of the market reversing additionally will increase because the pattern extends longer.

Foreign exchange Buying and selling Methods Set up Directions

Knowledge of the Crowd Foreign exchange Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the collected historical past knowledge and buying and selling indicators.

Knowledge of the Crowd Foreign exchange Buying and selling Technique offers a possibility to detect numerous peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional worth motion and modify this technique accordingly.

Really useful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Easy methods to set up Knowledge of the Crowd Foreign exchange Buying and selling Technique?

- Obtain Knowledge of the Crowd Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Knowledge of the Crowd Foreign exchange Buying and selling Technique

- You will note Knowledge of the Crowd Foreign exchange Buying and selling Technique is obtainable in your Chart

*Be aware: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain:

[ad_2]