[ad_1]

“Because the S&P 500 goes in January, so goes the 12 months.” In the event you’re a Inventory Dealer’s Almanac reader, you will be acquainted with this adage. Based on the Almanac, since 1950, this seasonal indicator has registered 12 main errors. That is an 83.3% accuracy ratio. Provided that 2023 is a pre-election 12 months, one other level to bear in mind is that, in 15 of the final 18 pre-election years, the complete 12 months adopted January’s route.

It seems just like the Almanac‘s expectations are on observe for January, which may imply a optimistic inventory market efficiency in 2023. After a dismal 2022, January’s efficiency has injected a dose of optimism into the markets. The S&P 500 index ($SPX) is up 6.17% in January, and S&P 500 shares have displayed robust efficiency—Tesla (TSLA), Amazon (AMZN), Apple (AAPL), and Nvidia (NVDA), to call a number of.

The January Indicator Trifecta

Though nothing is definite concerning the inventory market, when all three of the January indicators take a look at, it provides a little bit of consolation by way of investor sentiment. We had a Santa Claus rally within the final 5 buying and selling days in December and the primary two buying and selling days in January. It was a gentle rally, however a rally, nonetheless. January’s First 5 Days had been up and the January Barometer was optimistic.

Jeffrey Hirsch, Editor of the Inventory Dealer’s Almanac, famous in a tweet that, when all three January indicators are up, the subsequent 11 months are up 87.1% of occasions. That is a big likelihood. Does it imply you’ll be able to sit again, chill out, and undertake a buy-and-hold technique the place you’ll be able to watch your returns develop? In the event you’ve been buying and selling for some time, you already know that is by no means the case. There’s at all times an opportunity that we may see a selloff in the course of the subsequent 11 months. Any unexpected occasion may convey elevated volatility to the markets, which is one thing you need to be ready for, at all times.

Sector Performs

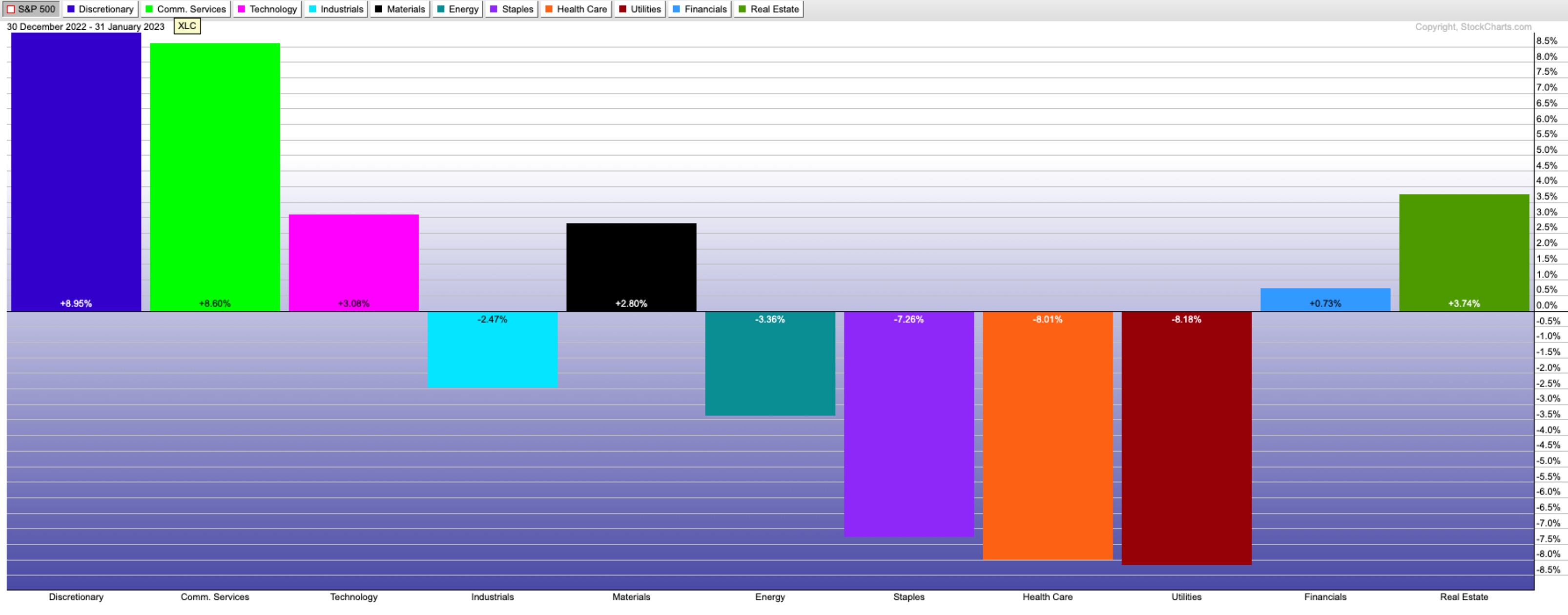

Taking a look at sector efficiency in January, topping the listing is Shopper Discretionary, up 8.76% adopted by Communication Companies, which was up 8.60%. Appears like risk-on buying and selling could also be coming again to the desk.

CHART 1: JANUARY S&P SECTOR PERFORMANCE. High of the listing is Shopper Discretionary, adopted by Communication Companies. Chart supply: StockCharts.com. For illustrative functions solely.

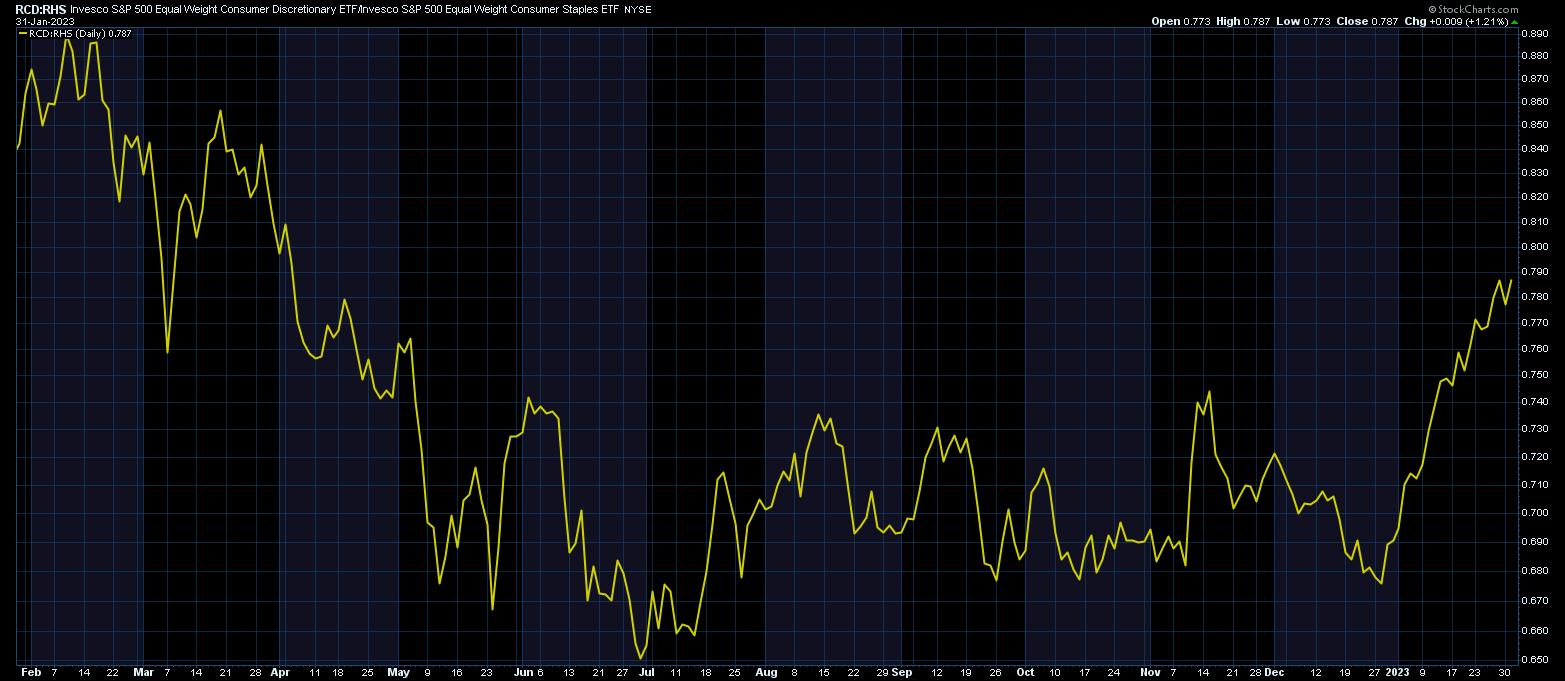

The ratio of Shopper Discretionary to Shopper Staples (see chart beneath) signifies that Discretionary is outperforming Staples, which means that, for now, buyers are leaning in the direction of extra offensive methods. Why? Numerous it could should do with investor expectations. Earnings season is underway and expectations are low. So, although earnings have been lukewarm, buyers aren’t speeding to promote their holdings. There’s additionally a Fed assembly happening and buyers are complacent with the concept of a smooth touchdown. The CBOE Volatility Index ($VIX) has been buying and selling beneath 20, which helps investor complacency.

CHART 2: CONSUMER DISCRETIONARY VS. CONSUMER STAPLES. When Shopper Discretionary shares are outperforming Shopper Staples, it is a sign that buyers are leaning towards risk-on buying and selling.Chart supply: StockCharts.com. For illustrative functions solely.

CHART 2: CONSUMER DISCRETIONARY VS. CONSUMER STAPLES. When Shopper Discretionary shares are outperforming Shopper Staples, it is a sign that buyers are leaning towards risk-on buying and selling.Chart supply: StockCharts.com. For illustrative functions solely.

Know-how shares have bounced again after getting overwhelmed up in 2022. The Nasdaq Composite ($COMPQ) is up over 10% in January. Apparently, small-cap shares are additionally on the rise, as indicated by the S&P 600 Small Cap index ($SML).

What Ought to You Watch Going Ahead?

Based on Hirsch, in pre-election years, February tends to be stronger than common years, and the Nasdaq tends to be the best-performing index, with the Russell 2000 being the second-best. Provided that know-how shares and small-cap shares ended January on a robust word, there’s an opportunity the pattern might proceed in February.

On the StockCharts platform, overview the Market Abstract frequently. Going into February, pay particular consideration to the Nasdaq Composite and the S&P 600 Small Cap index. Shares in these indexes may carry out nicely if issues pan out as specified by the Almanac. Keep in mind, markets are seasonal. Any indicators of a reversal in a selected space of the market may imply one other space is on the brink of take over. Recognizing adjustments in developments and capitalizing on them is what technical evaluation is all about.

Common monitoring of sector and business efficiency through the Sector Abstract and Market Abstract instruments can go a great distance in serving to you make your funding selections. Arrange Your Dashboard so it offers you a big-picture view of the market so you’ll be able to simply see when adjustments are happening available in the market. Add the Inventory Dealer’s Almanac 2023 to the combination, and you will be armed to plan your trades for the remainder of the 12 months.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to coach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Be taught Extra

Subscribe to ChartWatchers to be notified every time a brand new put up is added to this weblog!

[ad_2]