[ad_1]

Intel Company (INTC) is a number one American know-how firm and a number one producer of semiconductor chips. Intel, based in 1968, is understood for its central processing items (CPUs) that energy varied computing gadgets. The corporate has a market capitalisation of $140.27B.

Intel plans to report earnings for its fiscal second quarter ending June 2023 on Thursday, July 27 after the market closes.

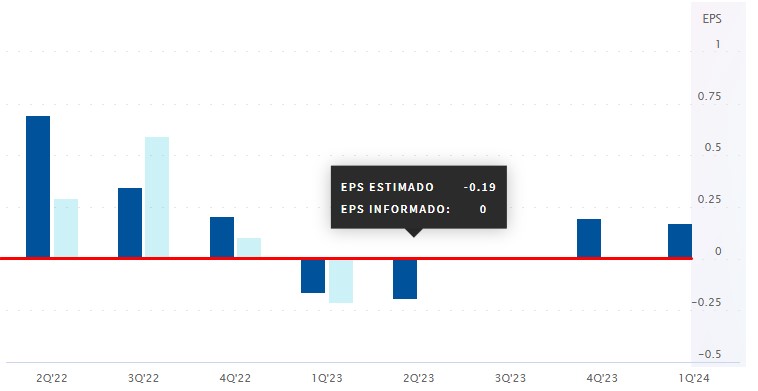

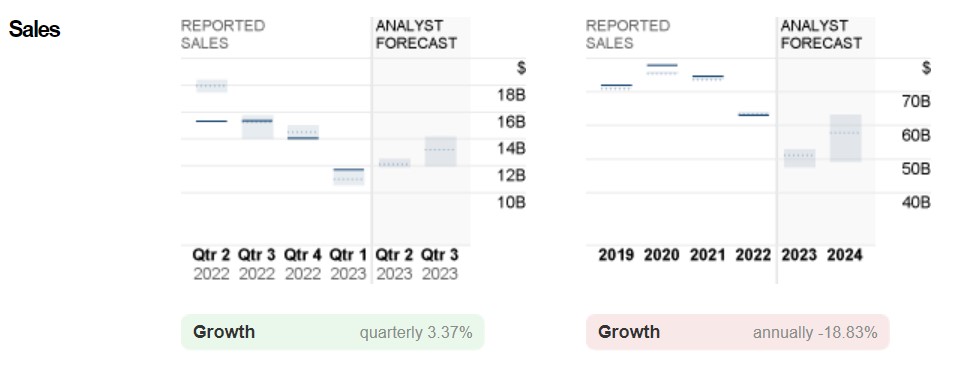

Zacks ranks Intel “Rank #2 – Purchase” within the High 33% at #82/251 within the Semiconductors trade. For this report, EPS is anticipated at $-0.03 ($0.19 for Nasdaq) with an ESP of 19.64%, marking a -113.79% year-over-year drop from $0.29. A revenue of $12.03B is anticipated, which might be a drop of -21.51% year-over-year from $15.32B.

The estimate has had no downward revisions and three upward revisions within the final 60 days. Intel has a P/E ratio of 78.21 and a PEG ratio of 14.99. The corporate has reported combined outcomes for the final 4 quarters.

Final quarter the corporate reported EPS of -$0.21 and income of $11.7B.

Relating to Intel’s share worth forecast for the subsequent 12 months, the bottom forecast is down -50.1% at $17.00, and the best expectation up +90.7% at $65.00, whereas the typical worth is down -6.1% at $32.00.

Components to contemplate

Within the second quarter, Intel collaborated with a number of firms which may put a constructive reflection on these outcomes.

First with Hewlett Packard Enterprise and the Division of Power to put in the “Aurora” supercomputer at Argonne Nationwide Laboratory making certain extraordinarily quick operations with its excessive efficiency “HPE Slingshot” framework.

There was one other collaboration with Ericsson to speed up the event of 5G infrastructure in Thailand supporting sectors similar to manufacturing, transportation and logistics supporting Intel’s prime line. This strategic collaboration will utilise Intel’s 18A course of (which is essentially the most superior node on the roadmap of 5 nodes in 4 years accessible by 2025) and Intel’s manufacturing know-how in Ericsson’s future optimised next-generation 5G infrastructure.

As our work collectively evolves, it is a vital milestone with Ericsson to accomplice extensively on its optimised next-generation 5G infrastructure. This settlement exemplifies our shared imaginative and prescient to innovate and remodel community connectivity, and reinforces clients’ rising confidence in our manufacturing course of and know-how” – Sachin Katti, senior vp and normal supervisor of Intel’s Community and Edge group.

As a part of the settlement, Intel will manufacture customized 5G SoCs for Ericsson to create extremely differentiated merchandise. As well as, they are going to prolong their collaboration to optimise 4th gen Intel Xeon processors with Intel vRAN Enhance for Ericsson’s Cloud RAN options. The 2 firms will work collectively to speed up their adoption on an industrial scale.

Ericsson has an extended historical past of shut collaboration with Intel, and we’re happy to develop this additional as we use Intel to fabricate our future customized 5G SoCs on its 18A course of node, which is in keeping with Ericsson’s long-term technique for a extra resilient and sustainable provide chain” – Fredrik Jejdling, government vp and head of Networks at Ericsson.

After Intel 20A introduces the brand new built-in gate transistor structure generally known as RibbonFET and bottom energy supply generally known as PowerVia, Intel will introduce ribbon structure innovation and elevated efficiency together with a discount in steady metallic line width at 18A. By combining their efforts, these applied sciences will elevate the subsequent merchandise Intel’s clients will convey to market and return Intel to course of management by 2025.

It additionally teamed up with Boston Consulting Group to develop dependable, enterprise-grade generative AI options to assist optimise operations, utilizing Intel’s AI supercomputer and a domain-specific base mannequin educated by BCG. That is an try to achieve a foothold within the new period of synthetic intelligence, which in comparison with AMD and NVIDIA, Intel might be extra subdued.

As well as, it delivered prototype multi-chip packages to assist the US Division of Protection’s mission to modernise and improve the aptitude of the defence industrial base for tools improvement and deployment.

Intel has introduced a change in its processor branding to simplify names and meet buyer requests beginning with the brand new technology of “Meteor Lake” processors. Excessive-end processors will now embrace “Extremely” of their branding, similar to “Intel Core Extremely 9”. Generational data will proceed to be added to the tip of the title. Intel has but to announce a launch date or particular particulars.

It’s potential that the energy within the knowledge centre enterprise from the primary quarter will proceed into this quarter and should offset weak spot within the PC end-markets enterprise subdued by low demand together with SMB and customers normally affecting Intel’s top-line figures.

To develop its presence in Europe, Intel launched a number of funding initiatives. The corporate and the German federal authorities signed an settlement for the corporate to take a position greater than €30 billion to develop its subsequent semiconductor manufacturing plant within the European nation. As well as, it stated it might construct a state-of-the-art semiconductor meeting and check facility close to Wroclaw, Poland, to satisfy rising demand for classy semiconductor options.

Then again, blockades placed on chips are a critical and worrisome drawback that will develop because of the rising geopolitical stress between the US and China. As well as, market volatility, stock changes, the falling greenback affecting the change fee and macroeconomic challenges proceed to have an effect on Intel’s web gross sales.

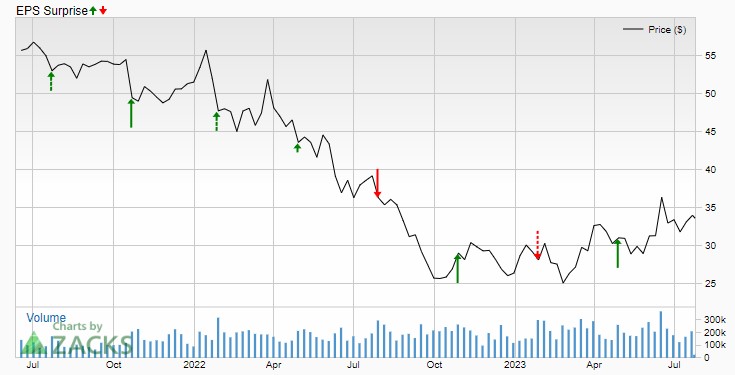

Technical Evaluation – Intel D1 – $34.05

Intel noticed a 64.10% drop from its 2021 highs at $68.47. Within the first quarter Intel rose 36.84% from its lows at $24.68 (very near the 2022 lows at $24.55 to the tip of the quarter at $32.56.)

This second quarter the worth retraced 76% from a low of $26.80 to present a second enhance of 38.19% to the highs of the quarter at $36.93. On this quarter and with the brand new momentum, the worth managed to break the bearish pattern line that had been in place because the highs of April 2021. Then, by the tip of the quarter and the start of the brand new quarter, the worth retraced to the damaged downtrend line, the 50-period every day SMA and the 50% Fibo at $31.87, presently holding above the 20-period every day SMA at $33.43 and the psychological stage of $35.00 awaiting its earnings outcomes.

Within the occasion that Intel comes out constructive on its earnings we may see a bullish distribution breaking the second quarter highs and searching for the July highs of final 12 months above the psychological $40.00 stage at $40.67 and near the 38.2% Fibo at $41.33. Conversely, if the end result is unfavourable, Intel’s worth may search for the primary or second quarter lows beneath the psychological $30.00 stage.

The ADX is at 16.37 with the +DI at 20.71 and the -DI at 18.56, with no pattern affirmation but. RSI is at 54.49, hovering across the 50 zone since June 21. 100 interval SMA W1 at $38.31

Click on right here to entry our Financial Calendar

Aldo W. Zapien

Market Analyst – South American Workplace

Disclaimer: This materials is offered as a normal advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]