[ad_1]

The day earlier than the all-but-done 25 bp Fed fee, Wall Avenue rallied, Treasuries slumped, and the USDIndex was little modified. Uncertainty over the FOMC’s coverage path by means of the remainder of the 12 months restricted exercise, nonetheless, amid place jockeying. Concurrently, Treasury yields edged barely greater because the market sees elevated threat the Fed will tighten additional past at this time. China optimism has already light once more and Dangle Seng and CSI 300 pared yesterday’s positive aspects. Cautious markets are ready for the Fed announcement at this time, whereas weighing China’s development outlook.

- FX – The USDIndex completed at 101.285, down from the sooner peak of 101.64. USDJPY at three days decrease at 140.50. GBP spiked to 1.2900 rebounding from 20-DMA.

- Shares –The US100 outperformed, rising 0.61%, whereas the US500 was up 0.28%, with the US30 up 0.08%. For the latter, it was enough for a twelfth consecutive achieve, simply shy of a report thirteenth. The JPN225 was little modified, the ASX up 0.9% on the shut, buoyed by a softer than anticipated quarterly inflation gauge .

- Commodities – USOil hit a excessive of $79.73 per barrel. It has not closed with a $79 deal with since April 19 and that would show a troublesome a troublesome resistance degree for now.

- Gold – prolonged to $1971.

Immediately: Fed coverage outlook: it’s Fed week with the FOMC fee determination at this time. All the focus shall be on the coverage assertion and Chair Powell’s press convention as a 25 bp hike is a performed deal. Implied Fed futures are mainly absolutely priced for that and are suggesting about 30% probability for a subsequent tightening by the tip of the November 1 assembly. A minimize is being priced in for late Q1 2024. Whereas we concur with the market view that this would be the final of the Fed’s tightening on this cycle, Powell won’t sound the all clear. Each he and the coverage assertion will go away the door open for extra motion forward if want be with knowledge dependency careworn. The assertion possible will reiterate that the financial system continued to broaden “at a reasonable tempo,” that job positive aspects have been “sturdy,” whereas unemployment remained “low,” with inflation nonetheless “elevated.” Uncertainty over the outlook may also be highlighted. Powell may also reiterate the necessity to return inflation to the two% objective and can stress policymakers stay “resolute” in that stance. Nonetheless, we might not be stunned if that concentrate on loosens up method down the street and is actually not absolutely achieved. However that shall be years within the making and to date sooner or later that it’s going to not damage credibility too badly.

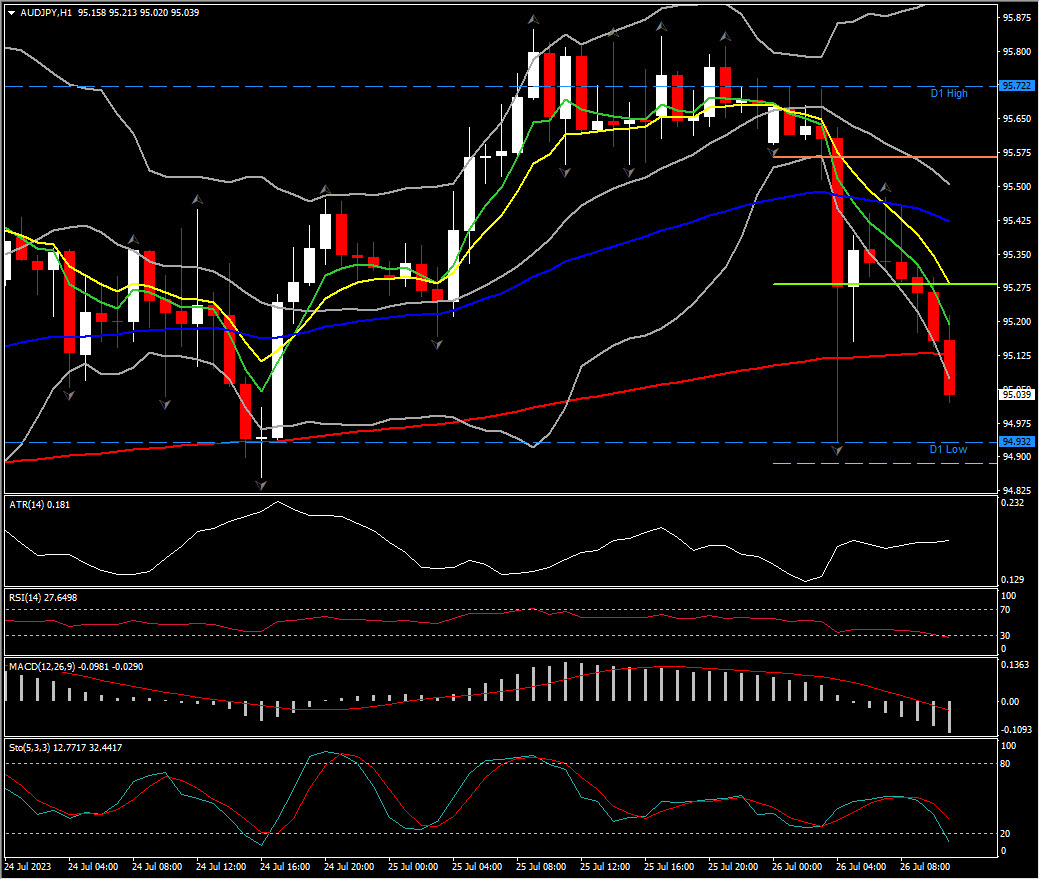

Largest Mover: (@6:30 GMT) AUDJPY (-0.64%) drifted to $94.93 with RSI at 27, MACD detrimental, whereas quick MAs aligned decrease.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a basic advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]