[ad_1]

- The Fed is anticipated to ship a 25 bps fee hike as we speak, however the future is unsure.

- The September assembly stays key to form up future coverage.

- The Fed has to take care of the steadiness between inflation and financial development.

The monetary world is abuzz with anticipation because the Federal Reserve gears as much as increase rates of interest by 25 foundation factors as we speak, doubtlessly reaching between 5.25-5.50%.

Whereas market members are intently monitoring the central financial institution’s strikes, latest indicators of decelerating inflation have sparked discussions about whether or not this fee hike could be the final within the present tightening cycle.

Let’s dive into the important thing elements influencing the Fed’s selections, the upcoming knowledge releases, and the financial projections that might influence the way forward for rates of interest.

The Fed’s Cautious Method Amid Promising Indicators of Decelerating Inflation

Regardless of indicators of inflation slowing down, the Federal Reserve is anticipated to take care of a cautious method in its tightening cycle.

Fed Chair Jerome Powell will possible underscore the central financial institution’s dedication to curbing inflation and doubtlessly reaffirm projections for a minimum of yet another fee hike this yr.

Key Information Releases and Financial Projections: September Assembly Holds the Key

The following FOMC assembly, scheduled for September 20-21, shall be essential in shaping the longer term course of rates of interest. The central financial institution will intently monitor key knowledge releases, together with two units of PCE inflation, CPI, and non-farm payroll figures.

Moreover, up to date financial projections from the Fed will supply additional insights into the central financial institution’s outlook.

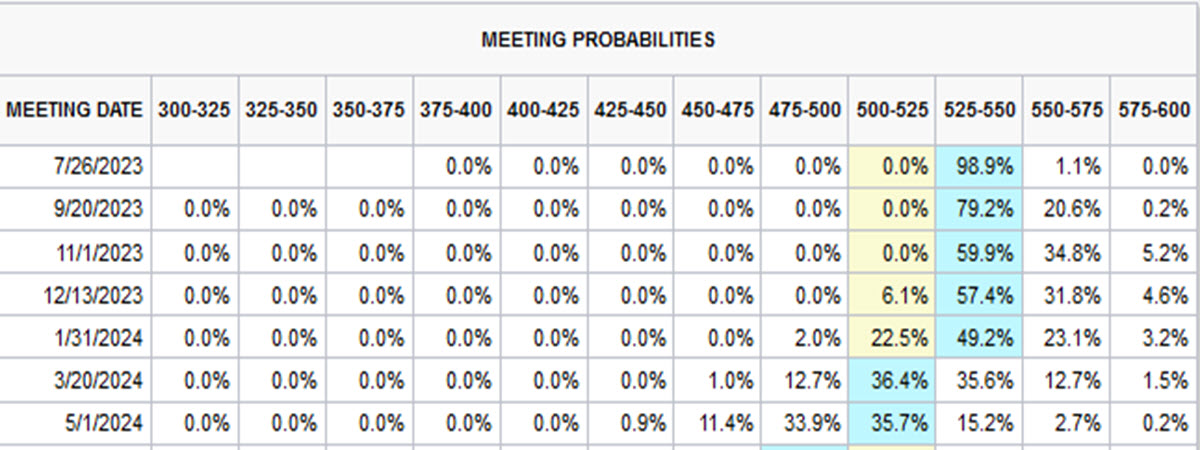

CME Watchtool

Market Expectations vs. Fed Projections: Diverging Views on Future Charge Hikes

Market expectations for future fee hikes are comparatively modest. The likelihood of one other fee hike is roughly 20% for September, 40% for November, and 36% for December.

Surprisingly, the first fee reduce for 2024 is already priced in for as early as Could, with an estimated likelihood of about 81%.

This divergence between market expectations and Fed projections provides to the uncertainty surrounding future financial coverage selections.

Reaching the “Sufficiently Restrictive” Stage: Balancing Inflation and Financial Progress

Since March 2022, the Federal Reserve has raised its benchmark fee from close to zero to over 5%, approaching a stage the central financial institution deems “sufficiently restrictive” to convey inflation all the way down to its goal of two%.

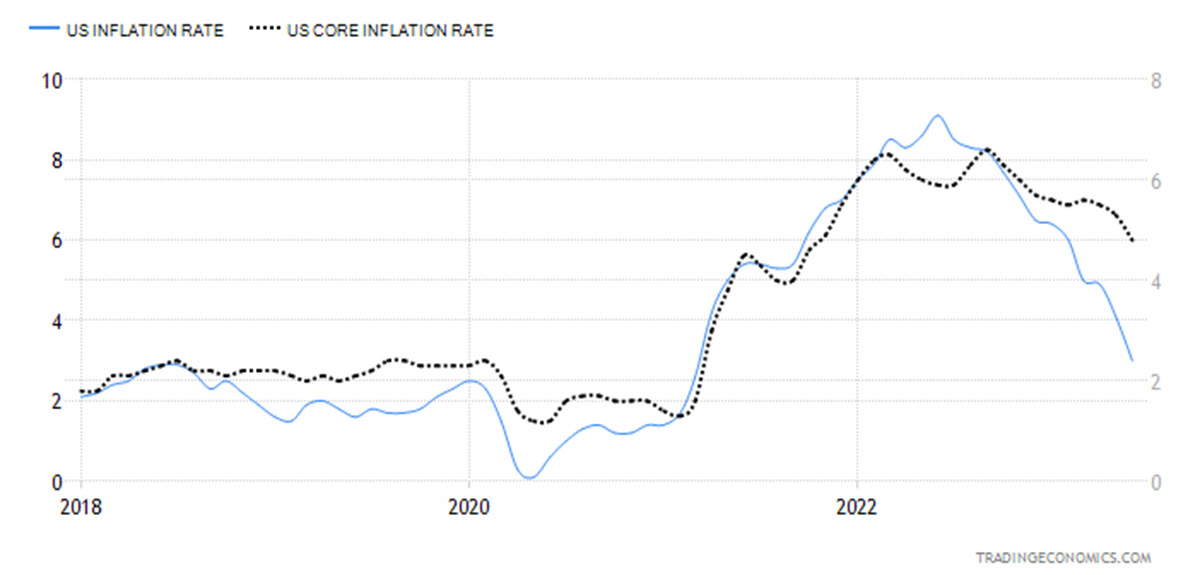

Whereas headline inflation has eased to three% in June, core inflation measures proceed to hover above the Fed’s goal. Officers intently monitor these traits to steadiness inflation management with out hampering financial development.

Headline / Core Inflation Charge

The Tug of Struggle: US Financial system Defies Expectations Amidst Inflationary Pressures

The US economic system has confirmed resilient, defying expectations of a sharper slowdown. Regardless of cooling off, the labor market stays sturdy, bolstering client spending. Whereas headline inflation has proven some indicators of aid as a result of eased vitality and meals costs, core inflation measures stay elevated.

This discrepancy led officers to revise their forecasts for core inflation, doubtlessly impacting the extent at which the fed funds fee will peak this yr.

Unsure Path Ahead: Assessing Future Charge Hikes

Market members and economists stay skeptical in regards to the chance of additional fee hikes this yr. With some officers deeming the September FOMC assembly “stay,” the Fed may increase charges then. Nonetheless, the central financial institution has a excessive bar for additional tightening in September.

Most analysts anticipate that if knowledge necessitates one other fee rise, it could possible be carried out on the November assembly.

Backside line

Because the Federal Reserve readies for one more rate of interest hike amid promising indicators of decelerating inflation, the monetary world awaits its resolution with bated breath. Placing a fragile steadiness between controlling inflation and supporting financial development stays difficult for the central financial institution.

The approaching months, marked by essential knowledge releases and financial projections, will decide whether or not the Fed can steer the economic system towards its long-standing inflation goal whereas avoiding potential recessionary pressures.

Click on right here to entry our Financial Calendar

Adnan Rehnan

Market Analyst – Academic Workplace / Pakistan

Disclaimer: This materials is supplied as a common advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or ought to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]