[ad_1]

Market Outlook #261 (twenty seventh March 2024)

Howdy and welcome to the 261st instalment of my Market Outlook.

On this week’s submit, I will probably be masking Bitcoin, Ethereum, Dogecoin, Synthetix, Mina, Kusama. Perpetual Protocol and Litentry.

This submit, I’m Binance-listed alts which have had close to two-year accumulation ranges which are solely simply breaking out. We’ve had months of on-chain mania, however nothing actually taking place on CEXes, and I believe we’re on the cusp of issues heating up for conventional retail, which implies centralised exchanges. It additionally means much less charges for us…

Subsequent week, we’ll be doing a quarterly overview and broader market views.

As ever, when you have any requests for subsequent week, please do let me know by way of e-mail or within the feedback.

Bitcoin:

Weekly:

Every day:

Worth:

Market Cap:

Ideas: If we start by BTC/USD on the weekly, we will see that the parabola continues to be very a lot intact for now and that final week noticed demand step in at $61k, pushing value all the best way again in direction of the weekly open, the place the pair closed out at $67.2k. This week’s early price-action has seen consolidation proper round prior cycle highs at $69k, with BTC rallying off the weekly open by way of $69k into $71.6k earlier than discovering resistance and now sitting simply above that key degree which has capped the weekly closes for the previous three weeks. From right here, given the energy of the buyback late final week after pushing low into the 60s, I might anticipate continuation increased while the parabola holds, with any weekly shut above $69k being the sign for value discovery, in my opinion. If we get that acceptance above $69k going into the tip of the month and the quarter, I believe April is tremendous bullish for BTC. Clearly if we proceed to reject at $69k, the extra doubtless it turns into that we lose momentum right here and break the parabola, resulting in an extended interval of consolidation earlier than continuation increased.

If we drop into the each day, we will see the three situations I marked out final week, with value following a fair sharper path than the extra bullish trajectory however principally mapping it out with that increased low adopted by continuation by way of prior cycle highs. On this timeframe, we did shut again above $69k a few days in the past and consolidated above it yesterday; I might now wish to see a wick under that degree that results in one other shut above $60k, confirming it as help, from which level I might be trying to $77k adopted by the 1.618 extension of this vary into $86.7k. Now, the bearish situation can be for one more rejection up right here, having closed above $69k after the higher-low, which results in $69k turning into resistance as soon as once more over the subsequent couple of days. In that occasion, we might anticipate to see one other run at $61k within the subsequent week or two earlier than taking part in out that extra shallow continuation sample that protects the parabola into late April. As we are going to see within the quarterly overview subsequent week, so long as we’re closing out March above $61k all of it seems to be fairly nice for the subsequent quarter.

Ethereum:

ETH/USD

Weekly:

Every day:

ETH/BTC

Weekly:

Every day:

Worth:

Market Cap:

Ideas: If we take a look at ETH/USD on the weekly, we will see that the pair adopted BTC increased after the dump final week, bottoming out at $3057 earlier than closing the week at $3454. Weekly RSI reset and is now in a pleasant spot for continuation increased. Early price-action this week has seen rejection round prior help turned resistance at $3580 and it’s key we now shut again above this degree: reject and transfer to recent weekly lows under $3400 and I believe we take one other stab at $3000 earlier than bottoming. Conversely, maintain above $3600 going into April and I believe that month sees the march to all-time highs. Dropping into the each day, we will see the extra bullish sample taking part in out right here with that increased low above $3284, and so from right here we have to see value defend that degree on any flush decrease intraweek after which shut by way of $3580 going into the tip of the week, the place I might then anticipate $3725 to change into reclaimed help and result in recent yearly highs by way of $4117 in early April. If we reject right here and shut under $3284, that will look very very similar to a lower-high and soon-to-be lower-low, with $3057 turning into a straightforward sweep from there, which might make that longer consolidation into summer season look extremely possible earlier than the run at new highs begins.

Turning to ETH/BTC, there may be little or no change right here at current, as final week noticed continued consolidation under the 360wMA as help turned resistance and help at 0.051, on which the pair is sat proper now. If we shut this week under this multi-month help degree, I might anticipate one other leg decrease to start for the pair by way of 0.049 into 0.046 in April, doubtlessly performing as a spring, very similar to the Might/June 2022 low formation. Till we get a weekly shut by way of 0.06, there may be nothing however continued chop to anticipate for this. Briefly turning to the each day, we will see how help turned resistance at 0.0533 final week and value retraced the whole push off 0.051 help, indicating that this subsequent take a look at is unlikely to be fruitful. Shut the each day under 0.051 and retest it from under as resistance and I believe 0.046 is all however assured from there.

Dogecoin:

DOGE/USD

Weekly:

Every day:

DOGE/BTC

Weekly:

Every day:

Worth:

Market Cap:

Ideas: Starting with DOGE/USD, on the weekly we will see that value has emerged from a near-two-year vary right here, having been capped by $0.12 because the breakdown in Might 2022 aside from one transient faux out. This additionally aligned with the 200wMA on the previous couple of makes an attempt, however final month the pair broke by way of $0.12, pushing into $0.15, the place it closed, confirming the breakout. Since, the pair has held above the vary for 4 week, wicking final week in direction of the vary resistance and 200wMA however front-running it as help and shutting at weekly highs round $0.177. We at the moment are consolidating proper under help turned resistance at $0.19 and the 23.6% fib of the bear market – the primary main resistance degree since breaking out. Given the construction right here, I’m anticipating to see a weekly shut by way of $0.19 in April that results in a push in direction of the subsequent main degree at $0.33, which aligns with the 38.2% fib. Momentum indicators are additionally pointing up. Trying on the each day, we will see that RSI reset to the mid-range on the latest dump, with DOGE v-reversing the whole sell-off to consolidating at yearly highs. If we do settle for above $0.19, the 1.618 extension of the present uptrend additionally sits proper round that resistance cluster at $0.33, offering extra confluence for that degree. Let’s see what early April brings…

Turning to DOGE/BTC, we will see that trendline resistance from the April 2021 all-time highs continues to be capping value, as is the 200wMA at 300 satoshis, under which value is at present sat, however final week noticed help discovered above the 360wMA at 186 and weekly construction maintain as bullish. So long as we will now maintain above 244, I believe we see the subsequent leg break by way of 300 satoshis and thru that trendline, with any weekly shut above that cluster of resistance opening up what’s prone to be a really sharp reversal, as is all the time the case with DOGE. If we do settle for above 300, I’m 480 as the subsequent main degree of help turned resistance, however finally I might anticipate this to proceed to rocket in direction of the all-time excessive at 1290 satoshis within the house of some months. Once more, dropping briefly into the each day, we will see how the 360dMA and 200dMA at the moment are performing as help, with the latter having capped most of the rallies for over a 12 months. Now we have a higher-low formation at 200 satoshis and the subsequent leg ought to take us into 340 satoshis as a primary goal, adopted by 480 satoshis.

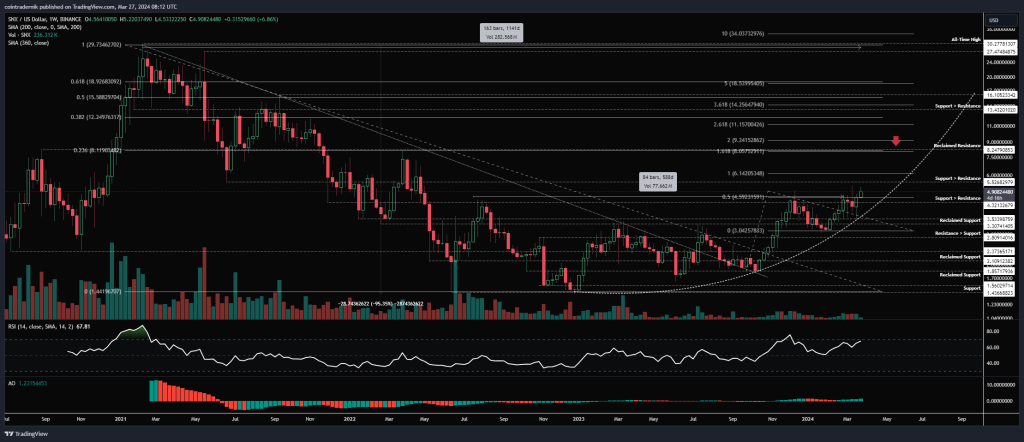

Synthetix:

SNX/USD

Weekly:

Every day:

SNX/BTC

Weekly:

Every day:

Worth:

Market Cap:

Ideas: Starting with SNX/USD, on the weekly we will see that following the weekly construction reverting to bullish on the shut by way of $3.30, value has fashioned a better low above prior resistance turned help at $3 and continued increased, marking out the beginnings of an uptrend and a sustained reversal. We at the moment are pushing by way of help turned resistance at $4.30 – a degree that had capped value for nearly two years prior. Acceptance above this degree will open up the subsequent phases of the market cycle for SNX, with an enormous open vary from this space into $8.25, with solely minor resistance at $5.50. That $8.25 are can be the 1.618 extension of the present development, in addition to the 23.6% retracement of the bear market, so plenty of confluence for that space. Lastly, we even have a extremely tight parabola taking part in out from the December 2022 backside, and if it continues to carry we should always see acceleration going into summer season, with a return to the 50% fib retracement and September 2021 highs at $16 someday earlier than September this 12 months. Dropping into the each day, we will see how there was some exhaustion on the latest push into $5.25, and value rejected, reset momentum indicators and v-reversed the whole dump, showcasing energy right here. So long as we now maintain above $4.30 this week, I believe we push by way of $5.50 and from there it’s clear skies in direction of $8.25.

Turning to SNX/BTC, we will see that the pair has been in a long-term downtrend because the 2020 highs, with a steeper trendline resistance in place since mid-2022, capping the most important highs throughout that point. Lately, the pair additionally closed under multi-year help at 7500 satoshis, pushing final week into 5400 satoshis and now sat proper again up close to that multi-year help. Now, this might go considered one of two methods: both SNX continues to under-perform and the multi-year downtrend persists, or we get an enormous sign to leap in. The latter can be the case if we, having closed under help and fashioned a spring, now reverse and settle for again above 7500 turning it into help once more. I might contemplate that the primary half of a serious reversal sign. From there, we might look to choose up spot with a view so as to add extra on a weekly shut above that trendline, doubtless round 9000 satoshis. Acceptance above that degree and I believe SNX begins a brand new bull cycle. If we briefly drop into the each day, I’ve marked out how this will likely play out, with 6900 performing as a better low earlier than the reclaim of 7500 and continuation increased. I will probably be keeping track of this for that setup as it’s considered one of my favoured backside formations.

Mina:

MINA/USD

Weekly:

Every day:

MINA/BTC

Weekly:

Every day:

Worth:

Market Cap:

Ideas: Starting with MINA/USD, we will see from the weekly that value has been consolidating all of this 12 months after a multi-month run late final 12 months, with $1.75 now performing as main resistance, the place the 23.6% fib of the bear market additionally lies. Weekly construction continues to be bullish right here and I might anticipate to see that increased low at $1 maintain agency; we might sweep it and rally off the sweep, or maintain this higher-low that’s at present in place, however what bulls don’t wish to see is a weekly shut again inside that $1 degree that capped MINA since June 2022. If we do sweep it and shut again above it, that may be a actually clear lengthy sign. Trying forward, I’m anticipating upside decision of this consolidation vary with a weekly shut by way of $1.80, which is able to result in the subsequent leg increased into $2.50 as main help turned resistance. From there, I believe we see the mid-range tagged at $3.50, which is main resistance. Dropping into the each day, we will see that each day construction is bearish right here with the lower-low on the break under $1.25, however that is simply basic chop inside a broader vary between $1-1.75, to be trustworthy. Till we see acceptance by way of both aspect of the vary, I wouldn’t be leaping into any levered positions, solely trying to maintain spot or add to to identify nearer to the underside of the vary for those who aren’t positioned.

Turning to MINA/BTC, we will see that after that vast run up into 3750 satoshis, value fashioned a decrease excessive and broke again under main help now reclaimed as resistance at 2275 satoshis, with some trendline resistance forming. We at the moment are sat again round prior resistance turned help at 1750 and the consolidation that preceded the earlier run increased. Weekly RSI has been reset and if this market is bullish we should always now see the formation of a low above 1595 satoshis that results in a breakout and shut above trendline resistance and 2400 satoshis. In case you are ready on the side-lines, I might look so as to add some spot on this space after which fill you place on that shut again above 2400 satoshis as affirmation of continuation increased. Trying on the each day, we will see that value is consolidating under the 200dMA and 360dMA right here, which isn’t one of the best signal, however we do have development exhaustion throughout indicators on this most up-to-date push decrease, offering some confluence for a backside formation. Once more, the principle factor to concentrate to right here is that transfer by way of 2400 – once we see that, then we will have assured in continuation increased.

Kusama:

KSM/USD

Weekly:

Every day:

KSM/BTC

Weekly:

Every day:

Worth:

Market Cap:

Ideas: If we start by KSM/USD, we will see that value has been capped by help turned resistance at $62.70 since June 2022, lately rejecting off it and forming a higher-low above $33.94, with $43.15 performing as help. These higher-lows forming with that multi-year flat resistance overhead makes me assume we see a breakout within the coming weeks, with any weekly shut by way of that degree opening up an enormous vary in direction of $105 as the subsequent resistance, with long-term trendline resistance above that close to $160, which might even be the 23.6% fib of the bear market. So long as this now holds above $34, I believe the subsequent section of its market cycle is imminent.

Turning to KSM/BTC, we will see the pair has been trending decrease for over 1000 days, forming a backside at 66k satoshis late final 12 months, rallying by way of long-term trendline resistance into 130k satoshis earlier than retracing now into 70k satoshis, the place bulls wish to see the formation of a better low. So long as 66k is now defended, we should always see value push again above 91k within the coming weeks, which might clearly mark out that higher-low formation from which the reversal can emerge going into the summer season. Trying briefly on the each day, we will see how sharply the 360dMA and 200dMA had been trending decrease, with the latter capping rallies, earlier than the pair reversed into the New 12 months. Now we have since damaged again under each MAs, however this isn’t unusual with altcoin cycles, and what we at the moment are searching for is that push again above 91k that also needs to convey the 200dMA above the 360dMA and mark out the start of the bull cycle for the pair. Having appeared on the prior cycle bottoms, alts would normally get round 300 days of upside after this crossover.

Perpetual Protocol:

PERP/USD

Weekly:

Every day:

PERP/BTC

Weekly:

Every day:

Worth:

Market Cap:

Ideas: Starting with PERP/USD, firstly wish to spotlight how comparable the bottoming formation right here is to SNX/USD, we that multi-year vary resistance capping costs, however higher-lows forming the beginnings of a parabola. Worth then depraved by way of vary resistance earlier this 12 months, retraced into reclaimed help at $1.04 and held a higher-low, and since rallied by way of vary resistance, now consolidating with it as help for just a few weeks. We wish to see this parabola maintain right here and value push off this help over the subsequent week or two by way of $1.70 into recent yearly highs past $2.25, with $3.60 as the subsequent key resistance above it. Turning to the each day, we will see how we’re forming higher-highs and higher-lows after that $1.04 degree held as help however there isn’t an enormous quantity of momentum right here, therefore the choppier behaviour. I might anticipate to see extra clearly trending price-action above $2. If we do settle for above that space, the 1.618 extension of this development ought to take us proper into that $3.60 degree which I’ve had marked out for months now as a magnet.

PERP/BTC, what I wish to spotlight right here is the distinction in bottoming formation with SNX/BTC. Quite than the continued downtrend, we flattened out at all-time lows round 1500 satoshis after which turned weekly construction bullish, now holding above key reclaimed help at 1950 satoshis. That is indicative of underlying energy in PERP vs SNX, and will manifest in higher upside when issues tick increased. From this space, we should always proceed to carry 1950 as help and break again above 2600 satoshis from right here, starting the subsequent leg up into 3600 satoshis and past. Solely as soon as we see a weekly shut by way of 3600 satoshis, nonetheless, can we be assured in disbelief turning into hope and the market cycle persevering with, with 5900 satoshis the most important resistance above that, adopted by 8460.

Litentry:

LIT/USD

Weekly:

Every day:

LIT/BTC

Weekly:

Every day:

Worth:

Market Cap:

Ideas: Lastly, if we take a look at LIT/USD on the weekly timeframe, we will see that the pair had been consolidating for nearly two years with $1.40 as vary resistance, however just a few weeks in the past the pair closed by way of trendline resistance from the all-time excessive after which by way of that vary resistance, now turning it into help and consolidating under resistance at $1.90. I might anticipate this breakout to end in continuation by way of $1.90 which is what the momentum indicators are suggesting right here, which might start Litentry’s first ever bull cycle. Dropping into the each day, we will see how cleanly resistance is being flipped as help right here and the present development ought to see us prolong into $2.20 within the coming weeks, the place we’d then wish to maintain above $1.90 as a higher-low earlier than pushing in direction of $2.90. I will probably be trying to maintain this at some point of the cycle, nonetheless, because it has by no means skilled a full bull and is well accessible for retail merchants, so I’m anticipating at the very least a retest of all-time highs earlier than the cycle peaks.

Turning to LIT/BTC, we will see that in contrast to the Greenback pair the BTC pair continues to be under trendline resistance however volatility has utterly flattened right here with development exhaustion evident. Now we have been consolidating between help turned resistance at 2800 satoshis and vary help round 2050 satoshis, and I might anticipate the transfer by way of $2 on the Greenback pair to convey with it a breakout past trendline resistance and vary resistance right here, which is able to give me extra confidence within the new cycle starting for Litentry. As soon as we’re above 3000 satoshis, I believe we start a parabola with 6200 satoshis as the primary main resistance, adopted by 12.2k satoshis.

And that concludes this week’s Market Outlook.

I hope you’ve discovered worth within the learn and thanks for supporting my work!

As ever, be at liberty to go away any feedback or questions under, or e-mail me instantly at nik@altcointradershandbook.com.

[ad_2]